EMI Calculator for Bike/Car Loan

EMI Calculator for Bike/Car Loan is a tool that can help any people calculate beforehand their economic ability to apply for car/bike finance and sustain subsequent repayment of the equated monthly installments. When it comes to working out the repayments on an auto loan, lenders use a standard formula. While it is possible to find out this formula very easily, working out your loan repayments this way does involve some rather complicated and lengthy calculations. The great thing about a Bike/Car Loan EMI calculator is that it uses the same formula to calculate loan repayments as the one used by lenders, however, these tools do not require you to perform any calculations yourself in order to get the figures you are after. An EMI calculator is an easy way for you to find out how much your auto loan will cost you and are consistent with the figures you will obtain from lenders as they are worked out the same way.

Equated monthly installment calculator (EMI) for your Bike/Car Loan.

The Bike/Car Loan EMI amount can also be calculated manually but it is better always to go for online Loan EMI Calculators as it is very easier to calculate without making an error when compared to calculating it manually. An Equated Monthly Installments (EMI) calculator gives you a brief idea of how you can pay back your loan. If you've taken out a Bike/Car Loan and want to know what your EMI and overall interest will be, this is the place to go. You can do so by entering the loan number, loan tenure, and interest rate in the form provided below.

Using a car loan EMI calculator is simple. All you need to do is enter the required information regarding your loan into the relevant fields and, with one click of a button, you will be able to obtain the figures relating to your loan repayments. This is, without a doubt, the easiest way to calculate your car loan repayments.

Amortization Schedule

With the use of a auto EMI calculator, it becomes easy to get the monthly amortization. However, it is also important for borrowers to understand how it is computed. Knowing how to compute it on your own will help you avoid any form of fraud.

What is Bike/Car Loan?

A Bike/Car Loan is a loan obtained from a bank solely for purchasing a vehicle . Banks and non-bank financial institutions (NBFCs) can provide you with a Bike/Car Loan. The vehicle is taken as a security by a financial institution for the auto Loan. so Bike/Car Loan is a secured loan. Nowadays, auto loans are also very reasonable.

Where can I get an easy Bike/Car Loan?

You may apply for a Bike/Car Loan online by visiting the websites of banks and nbfc. You must apply online or call their customer service representative to provide your information, after which they will arrange your appointment and an executive will contact you.

Who is eligible for Bike/Car Loan?

An auto loan is available to those with a daily and consistent source of income, so a salaried or businessman can apply. Here I want to add that every bank/nbfc has a different policy to fund customers , with some taking out Loans on 15000 salaries, others on 2000, and still others on 30000. Some banks only work with well-known multinational corporations, while others also work with Indian businesses. As a consequence, you must approach each person one by one in order to find a suitable match.

Bank/nbfc also consider the age of a person, he/she should be between 21 and 60 yrs old.

Even if all conditions are met, The credit history of the borrower is also checked by Bank/nbfc. they still look at the CIBIL score, which is an extremely important factor. The CIBIL score is a method of determining a person's creditworthiness based on information obtained from other banks in which the customer has done business. After the data is gathered, the CIBIL score is measured, which usually ranges from 3 hundred to 9 hundred, with three hundred being the lowest and nine hundred being the highest. Any applicant with a credit score of 750 or higher will be approved for a loan without difficulty.

What are the documents required for Bike/Car Loan?

General documents asked by the banks while providing Bike/Car Loan for Salaried person;

- Application form with 3 photos duly signed

- Age proof (PAN Card, passport or 10thstd marks card)

- Address proof (Passport, Aadhar card, Driving License, election card)

- ID proof (Aadhar card, PAN Card, Driving License , election card etc.,)

- Latest Salary slip of the last three months

- Bank statement of last six months (Salary account)

- Processing fee cheque

- Form 16 / Income Tax Returns

General documents asked by the banks while providing Bike/Car Loan for Self-Employed

- Application form with 3 photos duly signed

- KYC Documents (address proof, identity proof, age proof

- Company account bank statement of latest six months

- Office registration documents

- Proof showing that the business is in existence.

The list provided above is only indicative and exhaustive. It differs from bank to bank and it is at the discretion of bank as to what documents they require from each person. When an old customer who is holding an account with a particular bank for more than 10+ years obviously the trust they have on him/her will be more and hence documents asked will be less and scrutiny will be less. But that is not the case with a new customer who is requesting a Bike/Car Loan. In such cases, the scrutiny is higher and hence the documents that will be asked of such people will be more.

Bike/Car Loan Interest Rates, Fees & Tenure

Now consider at what interest rate the loan is available. You can negotiate with the dealer for the total price of the car and come up with an understandable amount. Though the interest rate may be fixed one can opt for flexible interest or fixed interest for the loan amount. There may be a lot of variations but it is usually observed that the companies offering loans on low-interest-rate often somehow charge the buyers in some other way and recover their dues. Whereas the loan lending institutions that offer car loans at a higher rate of interest, in the long run, turn out to be cheaper. One can also negotiate on the interest rate offered for the loan amount.

The interest rate of Bike/Car Loan ranges between 7% to 15% and generally, the tenure period is no longer than 3 to 30 years generally. There is also processing fee charged by the banks but differs from bank to bank.

What is Bike/Car Loan EMI ?

EMI means "Equated Monthly Installment."

EMI is a specific amount paid by a loan taker every month for a specific period of time. It helps you to know how much EMI you have to pay every month on the basis of your loan amount and period along with the interest rate. These calculators are easily available on almost any loan-site which you surf through your net. They guide us, as to how much EMI I would have to pay according to the interest rate with tenure. Usually, many people think of interest rates before taking any loan, whether it is a home loan, personal loan, car loan, etc. Thus to make you worry less and to satisfy your EMI needs, the EMI calculator helps you compare your eligibility & make you prepaid to take a further step forward to take your desired loan. It is a benchmark to measure various lenders against.

How you will calculate your Bike/Car Loan EMI?

If you are looking for an EMI formula to develop an EMI calculator, here is the exact EMI formula that can be used for calculating EMI amount for any given values of Principal, Interest Rate, and Loan Period:

The formula to calculate EMI:

EMI = P x r x ( 1 + r )n / ( ( 1 + r )n - 1 ) P for Principal (loan amount), r for the monthly interest rate (For e.g. If the Annual intrest rate is 10%, then r = 10/12/100= 0.008333), n for Loan Period in No. of months.

Loan Amount: The loan amount represents the total sum amount that an individual has borrowed from the banks or people (money lender) offering such loans in the market. The loan amount is for the quantity for which the individual is in need of money to get financed.

Rate of Interest: The Rate of Interest is charged upon the total amount of the loan. The rate of interest is never fixed it depends upon the period for which the loan amount is borrowed. It is said by experts that the loan taken for the longer period, then the rate of interest will be lower as compared to the short loan period.

Term: Term refers to the period for which one has to repay the loan amount which was borrowed by the individual. Term is also known as Tenure. The word includes a number of years. The term of repayment is to selected by the borrower, so that it doesn’t become a burden to repay the loan amount.

For Example : if you took a loan of Rs.1Lakh payable in twelve months at the rate of 16 % p.a., the EMI would be Rs 9,073. In the first month, Rs. 1,333 of this would be interest and the remaining Rs. 7740 would be the principal amount monthly, thereby reducing the principal to Rs. 92,260. for the second month, interest will be Rs. 1,230 and the remaining Rs. 7,843 would be the principal amount. and so on. Your total repayment amount shall be ₹ 1,08,877 which includes Loan Amount of ₹ 1 Lk and interest of ₹ 8,877.

How to calculate Bike/Car Loan EMI in Excel?

EMI value can be calculated in Excel. You can use the PMT function to calculate your EMI. One of the most efficient ways to determine monthly credit repayment obligations is to use an Excel spreadsheet to calculate loan EMIs. Here is the following syntax:

=PMT(RATE, NPER, PV, FV, TYPE) rate :- Rate of Interest per month. (Annual Interest rate/12) nper :- loan tenure in months. (year/12) pv :- Loan Amount. fv – future value [optional] type – describes when EMI are due (0 for end of the month. & 1 for beginning of the month)[optional]

For instance, if you want to find EMI value for a loan amount of 1,00,000 which is payable in say 5 years (i.e., 60 monthly installments) with an interest rate of say 10% p.a., the EMI can be calculated by placing the following formula in a cell in Excel spreadsheet:

=PMT(10%/12, 60, 100000, 0, 0);

Please note that the rate to use in the formula should be monthly rate (rate/12) i.e. 10%/12=0.8333% in the above example. The PMT function applies to all excel version. see below picture

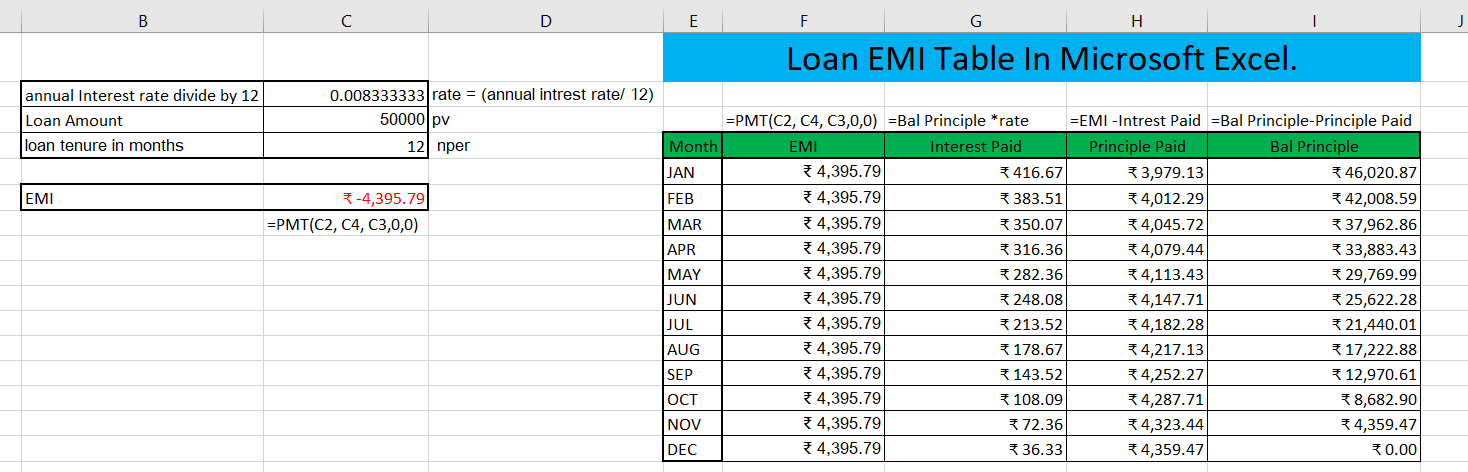

How to create Loan EMI Table In Excel.

- Use the "=PMT" formula to calculate your EMI.

- Use the "=Outstanding Principle * (Annual Interest rate/12)" formula to calculate monthly Interest Paid.

- Use the "=EMI -Intrest Paid" formula to calculate monthly Principle amount Paid.

- Use the "=Outstanding Principle-Principle Paid" formula to calculate Bal Principle amount.

VBA Code

This formula can also be used in VBA code. For instance:

Dim Emivalue As Currency

Emivalue = Pmt(RATE, NPER, PV, FV, TYPE)

Why You Should Use the Loan EMI Calculator?

Normally, the EMI calculator is used by anyone who plans to apply for a loan. It is a fact that there are different types of loans. Regardless of the loan type, the EMI calculator will still get the accurate answer that you need. Those who use the EMI calculator can be applying for a car loan, mortgage loan, home loan and other types of loans. In this article, the focus is on the loan EMI calculator. This refers to those who have an interest in loans. So, what are the advantages of using the loan EMI calculator?

Easy to use – It is easy and convenient to use because all it takes is to enter the values that are being asked. The details include the loan amount, interest rate and duration of the loan in the form of the number of years. Once all the information is entered, the monthly amortization instantly appear.

Accurate – Since there is no need to compute, the answer is considered to be accurate. The formula is already pre registered; therefore, it gives the closest answer if not the most accurate and exact.

Accessible – It is accessible in a way that it can be found online. Just look for a site that offers loans and you will surely find a loan EMI calculator.

Can be edited – Normally, loan applicants will try to find the most practical arrangement for a loan. This means that they will try all options to come up with the best choice. When using the EMI calculator, applicants can play with the values in order to find the best terms for the loan. Since it is electronic, you can easily change the values until you arrived at the best answer.

Online Bike/Car Loan EMI Calculator helps to calculate the total Interest and monthly EMI for SBI, Axis, icici, indusind, HDFC Bike/Car Loan.