MICR Code: Complete Guide to Bank MICR Codes in India | MICR Code

MICR Code: Complete Guide to Understanding Bank Cheque Codes

What is MICR Code?

The MICR (Magnetic Ink Character Recognition) code is a nine-digit code that is printed using special magnetic ink at the bottom of cheque. It helps in the automated processing of cheques and identifies the bank branch that issued the cheque. MICR code consists of three parts: city code (3 digits), bank code (3 digits), and branch code (3 digits).

If you've ever looked closely at a cheque, you might have noticed a series of numbers printed at the bottom. This is the MICR code, an essential component of banking that guarantees efficient cheque processing. In this comprehensive guide, we'll explain everything you need to know about MICR codes, how to find them, and why they're important for your banking transactions.

Quick Navigation

What is MICR Code in Detail

The banking sector uses a technology called MICR (Magnetic Ink Character Recognition) to make it easier to process and clear cheques. A special magnetic ink that is readable by MICR readers is used to print the MICR code, which is a numeric code that appears at the bottom of a cheque leaf.

Key Points About MICR Codes

- Printed in special magnetic ink that can be read by MICR readers

- Helps in the automated processing of cheques

- Reduces the time taken for cheque clearance

- Minimizes errors in cheque processing

- Consists of 9 digits in India (may vary in other countries)

- Unique to each bank branch

To handle the increasing number of cheques that banks were processing, the MICR technology was created in the 1950s. Before MICR, cheque processing was a manual and time-consuming task prone to errors. With MICR, banks can process thousands of cheques quickly and accurately, even if the cheque is slightly damaged or has writing on it.

MICR Code Structure: Understanding the 9 Digits

The MICR code consists of 9 digits in India, and each part of the code has a specific meaning. Understanding this structure can help you verify if a MICR code is correct and identify which bank and branch issued a particular cheque.

MICR Code Structure in India:

City Code (First 3 digits)

Identifies the city where the branch is located. For example, Mumbai is 400, Delhi is 110, Bangalore is 560, etc.

Bank Code (Middle 3 digits)

Identifies the bank. For example, State Bank of India is 002, HDFC Bank is 240, ICICI Bank is 229, etc.

Branch Code (Last 3 digits)

Identifies the specific branch of the bank. Every branch has a unique 3-digit code.

Example: Breaking Down a MICR Code

This MICR code (400002001) represents the State Bank of India's Fort Branch in Mumbai.

It's important to note that MICR code consists of how many digits can vary by country. While India uses a 9-digit format, the United States uses a 9-digit format with a different structure, and other countries may have their own formats.

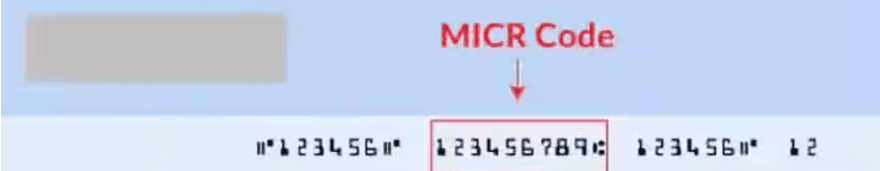

How to Find MICR Code on Cheque

Finding the MICR code on a cheque is straightforward once you know where to look. The code is always printed at the bottom of the cheque in a specific font called E-13B, which is designed to be easily read by MICR readers.

Steps to Find MICR Code on a Cheque

- Take your cheque and look at the bottom portion

- You'll see three groups of numbers printed in a special font (slightly different from regular numbers)

- The first group (on the left) is usually the cheque number (may be 6 or more digits depending on the bank)

- The middle group is the 9-digit MICR code

- The last group (on the right) is usually your account number

No Cheque Book? Other Ways to Find MICR Code

- Check your bank statement (often printed on it)

- Log in to your online banking portal (usually in account details)

- Contact your bank's customer service

- Visit your bank branch

- Use our MICR Code Finder tool

If you're wondering how to find MICR code of SBI or any other bank without a cheque book, the easiest method is to use MICR Code Finder tool, which has an extensive MICR code database for every Indian bank branch.

MICR Codes for Major Indian Banks

Below are some examples of MICR codes for major Indian banks. Please note that these are examples for specific branches, and the actual MICR code will depend on the branch where your account is maintained.

State Bank of India MICR Codes

SBI MICR codes follow the standard 9-digit format. Here are some examples of State Bank of India MICR codes for major cities:

- Mumbai Main Branch: 400002001

- Delhi Main Branch: 110002001

- Kolkata Main Branch: 700002001

- Chennai Main Branch: 600002001

- Bangalore Main Branch: 560002001

Union Bank of India MICR Codes

Union Bank of India MICR codes also follow the standard 9-digit format. Here are some examples:

- Mumbai Main Branch: 400026005

- Delhi Main Branch: 110026005

- Kolkata Main Branch: 700026005

- Chennai Main Branch: 600026005

- Bangalore Main Branch: 560026005

HDFC Bank MICR Codes

- Mumbai Main Branch: 400240071

- Delhi Main Branch: 110240001

- Kolkata Main Branch: 700240003

ICICI Bank MICR Codes

- Mumbai Main Branch: 400229057

- Delhi Main Branch: 110229002

- Bangalore Main Branch: 560229002

Find Accurate MICR Codes

The examples above are for reference only. For the most accurate and up-to-date MICR codes, we recommend using our MICR Code Finder tool. Simply enter your bank name and branch details to get the correct MICR code.

MICR Code vs. IFSC Code: Understanding the Difference

Both MICR and IFSC codes are used in banking, but they serve different purposes. Understanding the difference can help you use the right code for the right transaction.

Key Differences Between MICR and IFSC Codes:

| Feature | MICR Code | IFSC Code |

|---|---|---|

| Purpose | Cheque processing and clearance | Electronic fund transfers (NEFT, RTGS, IMPS) |

| Format | 9 digits (numeric only) | 11 characters (alphanumeric) |

| Structure | City code (3) + Bank code (3) + Branch code (3) | Bank code (4) + 0 (1) + Branch code (6) |

| Where to find | Bottom of cheque leaves | Bank statements, passbooks, online banking |

| Usage | Physical cheque transactions | Digital banking transactions |

In simple terms, if you're dealing with a physical cheque, you'll need the MICR code. If you're making an electronic fund transfer, you'll need the IFSC code. Both codes identify the same bank branch but are used in different banking systems.

Frequently Asked Questions About MICR Codes

Find Your Bank's MICR Code Instantly

Whether you need to find the MICR code for SBI, Union Bank of India, or any other bank in India, our MICR Code Finder tool makes it quick and easy. Having the correct MICR code is essential for smooth cheque processing and avoiding delays in clearance.

Our comprehensive database includes MICR codes for all bank branches across India, regularly updated to ensure accuracy. Simply enter your bank name and branch details to instantly find the correct MICR code.

Disclaimer

The information provided in this article about MICR codes is for general informational purposes only. Despite our best efforts to maintain the information current and accurate, we make no explicit or implied claims or warranties on the availability, suitability, accuracy, completeness, or reliability of the material provided here.

The MICR codes of banks may change over time. We advise readers to contact their respective banks directly through their official websites or customer care for the most current information before taking any action based on the content of this article.