Search STANDARD CHARTERED BANK ifsc code by account number

Here You can search ifsc code with account number. Everyone knows their bank account number and bank name. Just choose your bank name from Dropdown list and Enter the first 5 digit of your bank account number or bank code.

Find IFSC code by STANDARD CHARTERED BANK Account Number?

Yes, you can find the IFSC code with the account number. IFSC codes are allocated to bank branches and not to personal or other accounts. If you know the name of the bank and it is the code of the branch then you can find its IFSC code. If your account number has a branch code, it is often in the initial 5 figures of the account number. So you can get the IFSC code. The step is very easy with few selections from the dropdowns.

- Select the bank whose code you are looking for.

- Type the first 5 digits of your bank account number.(eg. A/c no. 0025312548594) or Branch Code

- Click the SUBMIT button.

NOTE:- If you have changed your bank branch then this tool will not work. before use read disclaimer

Search IFSC code by Account Number.

Enter Number

What is a bank account?

Bank account A system in which a bank takes money from a customer. It is managed safely by the client. Bank accounts help customers to save money. customer open bank account in order to more securely manage money. Customers get interest annually on the money deposited. Many people also use bank accounts to borrow money for big or small purchases. In this bank takes some interest from the customer.

how to open a bank account?

The branch of the bank has a separate window of customer service to open the bank account, by contacting it, you can get information about getting the form and filling it. For applying in the application form, two recent passport size color photographs are required. Along with identity proof, residence proof, date of birth proof is required.

A free online bank account is offered by most banks, credit unions, savings, and loans and other financial institutions to their customers as well as many other valuable banking services. There are many excellent benefits a free online checking account will provide you with. Internet banking customers can now do their banking business 24 hours per day 7 days per week from anywhere in the world. Since the inception of the Internet the way we conduct our business has changed immeasurably. The banking community has realized with the introduction of Internet banking (also known as Online banking) they can save money while providing their customers with greater access to banking services.

In order to receive a free online bank account, it usually takes approximately 30 min. You will also receive a Personal Identification Number (PIN) which will let only you log in to your account. You can access your account as often as you like. All in all, you will find online banking to be both convenient and time saving. You won’t go back to conventional banking once you start banking online.

For example, with a free online bank account you can balance your account electronically, transfer funds between eligible accounts, make payments to your credit card, receive cash advances from your credit card, re-order checks, pay your bills online, review current and past bank statements and request customer service online.

Your free online account can now be accessed 24 hours a day and include the following features:- Review current and past financial statements.

- Check account balance and deposits.

- Transfer funds between accounts.

- Access your small business accounts.

- Re-order checks.

- View balance on credit card and get an activity report.

- Download your transactions directly to a financial management program.

- Request customer service assistance online.

- Keep track of balances, payments, and interest earned.

The Reserve Bank has made it mandatory PAN card and Aadhaar to open any kind of bank account. Whether opening a savings account or a current account, this rule will apply to all.

How do I know my bank account number?

- The bank account is printed on the Cheque Book

- The first page of the passbook contains all bank account details including the bank account number.

- The account number is printed on the monthly statement sent by the bank

- You can see your account number in the account details on the NetBanking platform

- Account number can be viewed on your bank's mobile app.

- Go to your bank branch where the account has been opened.

- The account number is mentioned in the welcome letter that is received after the bank account is opened.

Types of Bank Accounts

| Savings Account | Current Account | Recurring Deposit Account | Fixed Deposit | |

|---|---|---|---|---|

| Open | individual or joint | Enterprise, firm, company, Associations, Institutions | individual or an Institution | individual or joint |

| Withdrawal | a restriction on the no. times money withdrawal | No Limit | Term completion | Term completion |

| interest | 4% to 6% per annum | NO | 6% to 7% per annum | 6% to 9% per annum |

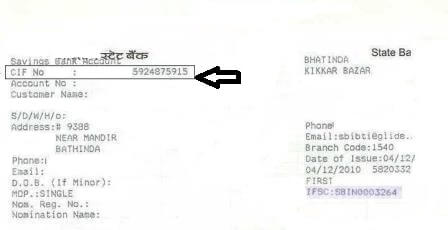

What is a CIF number? And how to know CIF number?

The bank issues different CIF numbers to its customers. In which all your details are present such as your name, your father's name, your mother's name, your address, your date of birth, and your personal details are also present. It is known by many other names which are CIF number, Customer ID, CRM number, User ID etc. If you do not confuse that these are different numbers.

You can see your CIF number in your passbook and if the CIF number is not printed on your passbook then you can find it by going to your bank.

What Is the Meaning of IFSC Code?

An eleven character code is used to identify any bank branch. This code is called IFSC code. IFSC is an abbreviation of the Indian Financial System Code Which is the unique code of each Bank Branch. What we call IFSC code in short. This is an alpha-numeric code of 11 digits. This helps in finding the details of all bank branches in India. RBI can easily identify any branch in India because of the IFSC code. This code has been given to every bank branch which facilitates the NEFT Transaction system. This system is designed for domestic use only in India.

The Reserve Bank of India has created the NEFT network. IFSC codes are covered under it. Which helps in sending money through RTGS, IMPS or NEFT. IFSC Codes are used by no.of banking institutions in India to carry out RTGS and NEFT transfers. IFSC India Codes are also used for streamlining and identifying monetary transactions between different bank branches and accounts. For these listed bank branches that are participating in NEFT or RTGS, you can check the IFSC Codes.

How to use IFSC Code

IFSC code of bank and branch is required to fund transfer from any bank to other bank. This method used for transfer payment for insurance, expense, purchase, mobile bills payment, bus, flight ticket booking, online shoppings and many more.

What Can You Use the IFSC Code For?

STANDARD CHARTERED BANK IFSC code is used for online fund transfer transactions via Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT), Immediate Payment Service, an interbank electronic instant mobile money transfer service (IMPS). The main motive of the IFSC is to make internet banking simple and safe.

National Electronic Fund Transfer is known as NEFT. NEFT is a popular Online Fund Transfer System. Using NEFT you can transfer money from one bank or bank branch to another.

Real Time Gross Settlement is known as RTGS. RTGS is used for settling financial transactions through online. To initiate RTGS payment you need to enter the IFSC code of the selected Bank Branch. By using RTGS method you can make payments in a simplified manner. Hence you can easily find your IFSC code for any of the Banks, Bank Branches in India.

Methods of transferring money using STANDARD CHARTERED BANK IFSC Code

| Payment Service | NEFT | RTGS | IMPS | UPI |

|---|---|---|---|---|

| Full Form | National Electronic Fund Transfer | Real Time Gross Settlement | Immediate Payment System | Unified Payments Interface |

| Process | Transfer funds in just two hours | Instant | Instant | Instant |

| Transfer Limit | Re.1 to No limit | Rs.2 lakh to No limit | Re.1 to Rs.2 lakh | Rs 1 Lakh or 10 Transactions (calculated on 24 Hours basis) |

| Operational Timings | Available 24*7, 365 days | Monday to Saturday (Except 2nd and 4th Saturday and bank holidays) - 7:00 AM to 5:00PM | Available 24*7, 365 days | Available 24*7, 365 days |

| Inward Transaction Charges | No charges | No charges | Decided by individual member banks and PPIs | No charges |

Find STANDARD CHARTERED BANK Ifsc Code, MICR Code with account number. Just follow the simple steps below to get the IFSC code, MICR Code, Branch address, contact of all indian banks.